The Present Value Calculations inputs control if and how the cash flows are discounted to calculate the present value at the Trial Date. All cash flows are assumed to occur at the end of the relevant discounting period. For most periods this will be at year end. Periods that do not end with the year include the last pre-trial period and the final post-trial period.

For help entering the rates to apply, see Interest and Discount Rates.

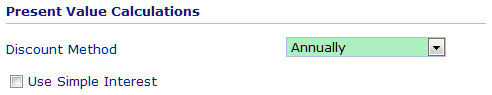

Present Value Calculations Inputs

The Discount Method input determines if the cash flows are discounted and if periodic compounding is applied.

| • | Annually: Cash flows are discounted. Interest rates are not compounded periodically. |

| • | Quarterly: Cash flows are discounted. Interest rates are compounded quarterly (compounded rate = 1+(i/4))^4)-1). |

| • | Monthly: Cash flows are discounted. Interest rates are compounded monthly (compounded rate = 1+(i/12))^12)-1). |

| • | Do Not Discount: Cash flows are not discounted. |

Fill this checkbox to apply simple interest. Empty it to apply compound interest.