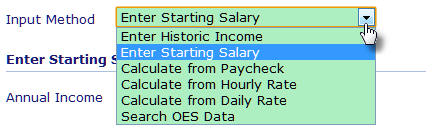

There are six methods for entering a job's income. Select the method you want to use from the list at the top of the workspace:

Selecting the Income Input Method

For help using the input methods see below.

Use this method when you have historic income data for the job, such as W2 forms.

|

This is the simplest of the input methods. Just enter the annual starting salary into the input box labeled "Annual Income" and you're done:

|

Calculating the starting salary from a paycheck requires two inputs: the Paycheck Amount and the Pay Period. From those inputs the application calculates the annual income:

Annual Income FormulasThe formulas for Annual Income are as follows:

|

Calculating the starting salary from an hourly rate requires three inputs if you select a standard pay period (Weekly, Bi-Weekly, Semi-Monthly, or Monthly) and four inputs if you select a Custom pay period. If you select a Custom pay period, in addition to entering the Dollars Per Hour and the Hours Per Paycheck, you must also enter the number of Paychecks Per Year. From those inputs the application calculates the annual income:

Paychecks Per Year FormulasThe formulas for Paychecks Per Year are as follows:

|

Calculating the starting salary from a daily rate requires two inputs: Dollars Per Day and Work Days Per Year. From those inputs the application calculates the annual income:

|

The Search OES Data method lets you set the starting salary using Occupational Employment Statistics (OES) data from the Bureau of Labor Statistics (BLS). For help using this method see Search OES Data Method. |